Facts About Custom Private Equity Asset Managers Uncovered

Wiki Article

The Facts About Custom Private Equity Asset Managers Uncovered

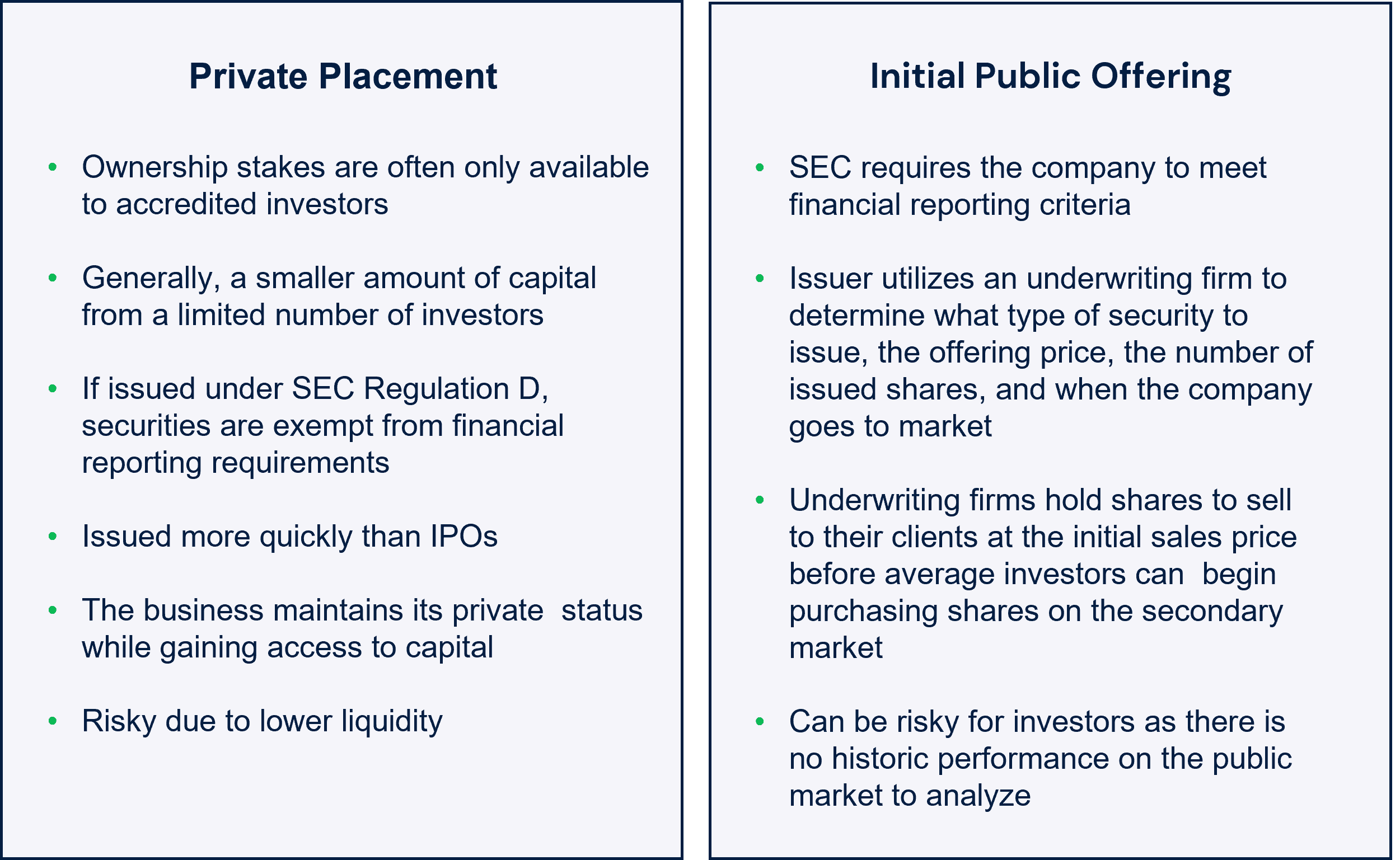

(PE): investing in firms that are not publicly traded. Approximately $11 (https://parkbench.com/directory/custom-private-equity-asset-managers). There may be a few points you do not understand regarding the market.

Companions at PE companies increase funds and handle the money to generate beneficial returns for shareholders, typically with an investment perspective of in between 4 and seven years. Personal equity firms have a series of investment preferences. Some are stringent financiers or easy capitalists entirely reliant on administration to expand the company and generate returns.

Because the most effective gravitate toward the larger bargains, the middle market is a significantly underserved market. There are a lot more vendors than there are extremely seasoned and well-positioned finance professionals with comprehensive purchaser networks and resources to take care of a deal. The returns of personal equity are commonly seen after a couple of years.

The 9-Minute Rule for Custom Private Equity Asset Managers

Traveling listed below the radar of large international firms, a number of these small companies typically provide higher-quality customer support and/or particular niche products and solutions that are not being supplied by the large conglomerates (https://slides.com/cpequityamtx). Such benefits draw in the interest of exclusive equity companies, as they have the understandings and smart to exploit such opportunities and take the firm to the next degree

Most supervisors at profile firms are given equity and incentive compensation frameworks that compensate them for hitting their economic targets. Private equity possibilities are typically out of reach for individuals who can't spend millions of dollars, but they shouldn't be.

There are laws, such as limitations on the accumulation quantity of cash and on the variety of non-accredited investors. The personal equity service attracts a few of the most effective and brightest in business America, consisting of top performers from Fortune 500 business and elite administration consulting companies. Law office can also be hiring premises for private equity employs, as accountancy and legal skills are essential to complete bargains, and purchases are very demanded. http://peterjackson.mee.nu/where_i_work#c1942.

Facts About Custom Private Equity Asset Managers Uncovered

One more downside is the absence of liquidity; once in a private equity deal, it is difficult to leave or market. There is an absence of adaptability. Private equity also comes with high charges. With funds under administration already in the trillions, private equity companies have actually come to be eye-catching financial investment cars for well-off people and organizations.

For decades, the qualities of personal equity have made the asset course an attractive proposition for those who could participate. Now that access to exclusive equity is opening up to more private capitalists, the untapped capacity is coming true. So the question to consider is: why should you invest? We'll begin with the main arguments for spending in personal equity: Just how and why personal equity returns have traditionally been greater than various other possessions on a number of levels, Exactly how consisting of private equity in a portfolio influences the risk-return profile, by assisting to branch out against market and intermittent risk, After that, we will certainly lay out some crucial considerations and dangers for private equity capitalists.

When it pertains to introducing a brand-new property right into a profile, one of the most standard factor to consider is the risk-return account of that asset. Historically, personal equity has shown returns similar to that of Arising Market Equities and greater than all various other conventional possession classes. Its fairly reduced volatility combined with its high returns produces a compelling risk-return account.

Little Known Questions About Custom Private Equity Asset Managers.

As a matter of fact, exclusive equity fund quartiles have the best series of returns across all alternative asset classes - as you can see listed below. Methodology: Interior price of return (IRR) spreads out calculated for funds within classic years independently and then balanced out. Median IRR was computed bytaking the average of the average IRR for funds within each vintage year.

The takeaway is that fund option is important. At Moonfare, we lug out a stringent selection and due diligence process for all funds detailed on the system. The result of adding exclusive equity right into a portfolio is - as always - based on the portfolio itself. Nonetheless, a Pantheon study from 2015 recommended that including exclusive equity in a portfolio of pure public equity can open 3.

On the other hand, the very best personal equity companies have accessibility to an even bigger pool of unidentified opportunities that do not deal with the exact same examination, as well as the resources to execute due diligence on them and identify which deserve buying (Syndicated Private Equity Opportunities). Investing at the very beginning means greater danger, yet for the firms that do prosper, the fund benefits from higher returns

About Custom Private Equity Asset Managers

Both public and personal equity fund supervisors devote to spending a percentage of the fund however there stays a well-trodden concern with lining up rate of interests for public equity fund monitoring: the 'principal-agent trouble'. When an investor (the 'major') works with a public fund supervisor to take control of their capital (as an 'agent') they hand over control to the supervisor while preserving ownership of the possessions.

he has a good pointIn the instance of personal equity, the General Companion doesn't just earn a management cost. They additionally earn a percentage of the fund's earnings in the form of "lug" (usually 20%). This ensures that the interests of the supervisor are straightened with those of the financiers. Private equity funds likewise alleviate one more form of principal-agent trouble.

A public equity financier inevitably desires one point - for the monitoring to raise the stock rate and/or pay out dividends. The financier has little to no control over the choice. We showed over exactly how many exclusive equity methods - specifically bulk acquistions - take control of the operating of the business, guaranteeing that the long-lasting worth of the firm precedes, pushing up the return on investment over the life of the fund.

Report this wiki page